Lower Volatility in Summer

All of the major currency pairs tend to see a large reduction in volatility during the summer months, with smaller price moves every day, and the EUR/USD pair is no exception.

If you look at the average true range of this particular pair (using the ATR indicator), you will see that it has dropped to around 65 points right now at the end of July 2018, which makes it fairly hard to trade for any short-term traders.

Narrow Price Range

As well as having small price moves, it has also been trading in a narrow, sideways price range with no clear direction.

The 20, 50 and 100-day EMAs are all very close together and the Bollinger Bands are also very narrow, which helps to confirm this narrow trading range.

More importantly, if you draw two trendlines joining the highs and lows of the recent trading range, as shown in bold in the price chart below, you can see that the price is trading is an ever decreasing trading range, which is often the pre-cursor to a major breakout.

Potential Trading Opportunity

Subsequently, this represents a possible trading opportunity because if the price breaks strongly upwards or downwards (and closes outside this range and outside the Bollinger Bands on the daily chart), this is potentially a good time to open a new position and capitalize from this breakout.

(Disclaimer: These are just my own thoughts and ideas, and it doesn’t represent financial advice in any way. Please do your own research before opening any positions.)

A Word of Warning

Trades like these are often very profitable because everything is in place for a strong breakout (narrow EMAs, narrow Bollinger Bands, trading within trendlines, etc), but you have to be careful during the summer months because volumes are lower and sometimes these breakouts don’t have the momentum to be sustained for very long.

It will be interesting to see what happens anyway because the price has to break out of this ever decreasing price range very soon, and so there could potentially be a big move upwards or downwards in the coming weeks if there is some momentum behind this breakout.

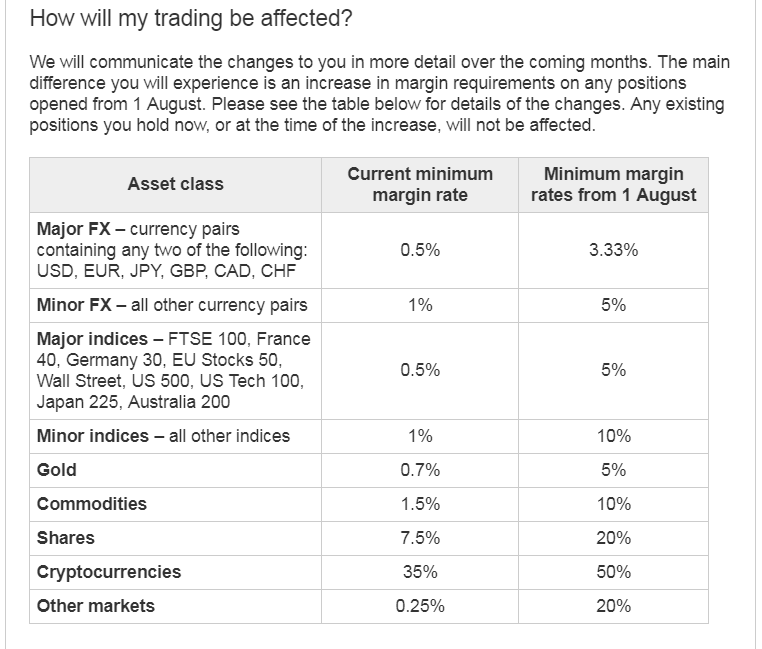

The bad news for traders based in Europe is that they are now going to need more capital in their trading accounts in order to trade these cryptocurrencies.

The bad news for traders based in Europe is that they are now going to need more capital in their trading accounts in order to trade these cryptocurrencies.