Who is Aimstrader?

Aimstrader is a trader from the Netherlands called Jeroen Dekker who has rapidly made quite a name for himself on the eToro social trading platform throughout 2018.

At a time when many traders on eToro have struggled to make any profits, particularly after the heavy stock market falls that we have seen this month and the fall in cryptocurrency prices that have continued throughout 2018, Aimstrader has continued to generate consistent profits every month.

Markets Traded

One of the reasons why Jeroen has avoided any heavy losses and outperformed many other traders on eToro is because he doesn’t actually trade or invest in shares, and avoids trading cryptocurrencies. He is purely an index trader.

He seems to trade the German DAX 40 index the most (45.5% of his trades), but he also likes to trade the Nasdaq (22%), the Dow Jones (7.5%) and the French CAC40, and most of his trades are closed within 4 hours on average. So he could be classified as a short-term trader or day trader.

Trading Performance

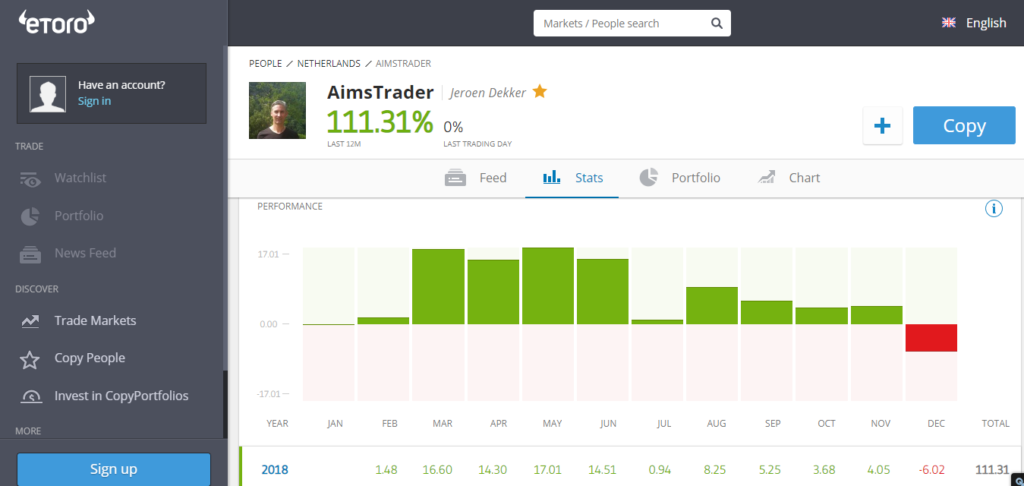

Aimstrader has been trading since February 2018, and at the time of writing (30 October 2018), his results are still very impressive.

As you can see from the screenshot above, he hasn’t yet had a losing month since he first started trading, and has generated a total profit of 114.05% so far, with the best month being May where he generated a profit of just over 17%.

After a superb 4-month run, the results haven’t been quite as impressive since July, but he has still managed to make some decent profits every month.

Furthermore, when you look at his overall success rate, it is hard to find fault because out of 532 trades, he has a win ratio of 87.22%.

If you look at the chart of his performance, you will see that Jeroen Dekker doesn’t seem to have periods of heavy drawdown either, like some of the traders on this platform, which is why he has a reasonable risk score of 4 right now.

Past performance is not indicative of future results.

Trading Performance Update (December 2018)

December has been a terrible month for many of the traders and investors on eToro (including myself), and Aimstrader has also had an unusually poor month as well.

After admitting that he deviated from his usual day trading strategy at times, he is currently down 6.02% in December at the time of writing, and the reason why is because he has continued to open long positions on the major indices, which haven”t always reversed as the markets have continued to fall sharply.

As a result of this poor performance, Aimstrader has lost 10% of his copiers in the last 7 days alone, but overall it has still been a very profitable year for this popular trader because he is still up 111.31% this year, and I’m sure he will get things back on track in 2019.

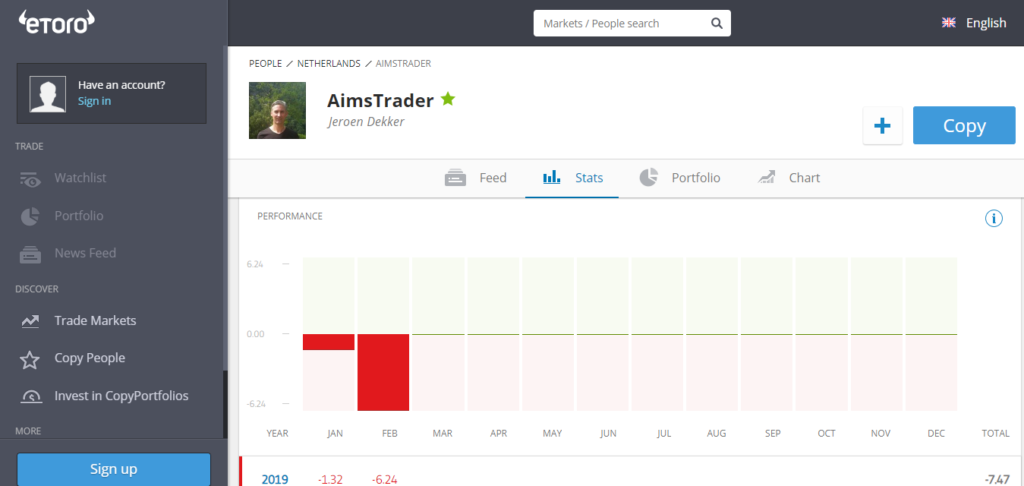

Trading Performance Update (February 2019)

I mentioned in my previous update that Aimstrader had a bad month in December, and unfortunately his losing streak seems to have continued into 2019.

After ending December down 4.21%, he had a mediocre but generally acceptable January with a loss of 1.32%, but it is February that has resulted in big losses for many copiers, and encouraged many people to stop actively copying him.

That’s because at the time of writing (22 February 2019) he is currently down 6.24% for the month after some disastrous trades on the CAC40.

Aimstrader attempted to call a possible reversal on the CAC40 with a series of five short positions, but he was forced to close them all out for losses of between 22.33% and 42.98% as the markets just kept on going up.

Subsequently, he is now down approximately 11.73% in the last three months alone, which has resulted in many copiers incurring some heavy losses because he attracted many new copiers during this time.

Trading Strategy

As mentioned above, Aimstrader is very much a short-term trader because each trade lasts around 4 hours on average, and he tends to place an average of 14-15 trades per week.

Although he doesn’t reveal any details about his trading strategy, he points out in his profile that he has years of experience as a trader and aims to make a profit of at least 50% per year, with consistent profits every week and every month.

He also says that his trading method is based on a combination of fundamental and technical analysis, and although he may sometimes place several trades per day, he doesn’t necessarily trade every day if there are no decent trading opportunities.

Copiers

Jeroen Dekker, aka Aimstrader, is still one of the most popular traders to follow on eToro, with 24,906 followers and 4078 people actively copying his signals, with over $5m invested in him.

Final Thoughts

Aimstrader is a standout trader right now at a time when many of the leading traders on eToro have lost money, but he has only been trading for about a year.

So we will have to wait and see if he can continue to deliver equally good results in the months and years to come.

If you would like to keep an eye on this trader, you might want to bookmark this page or follow him on eToro, and if you are confident in his abilities, you can of course choose to invest money with this trader, but please read the disclaimer below before doing so.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management. 81% of retail investor accounts lose money when trading CFDs with this provider.

Cryptocurrencies such as Ripple, Litecoin, Ethereum and Dash are continually being mentioned on the various different financial news channels and websites , but it is fair to say that Bitcoin is still the most well-known of these cryptocurrencies, and the most talked about.

Cryptocurrencies such as Ripple, Litecoin, Ethereum and Dash are continually being mentioned on the various different financial news channels and websites , but it is fair to say that Bitcoin is still the most well-known of these cryptocurrencies, and the most talked about.