Bad Timing

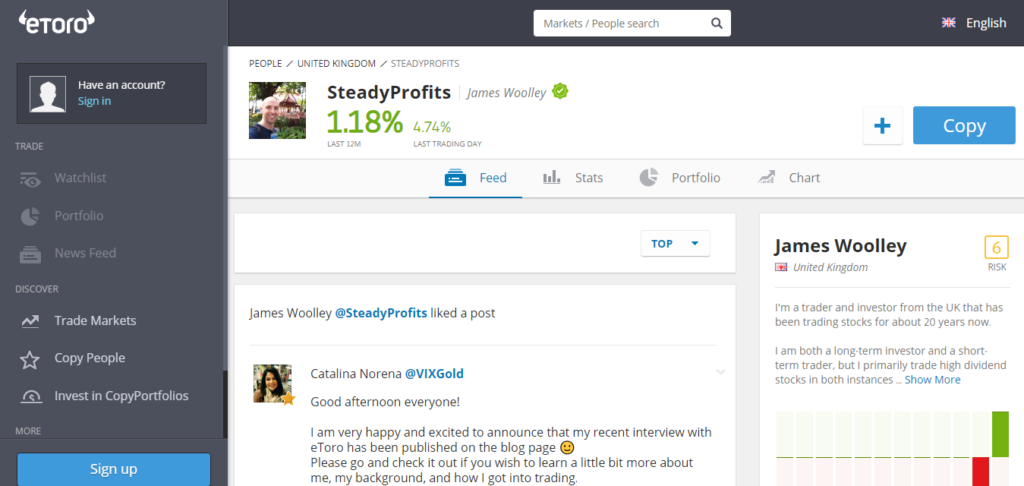

Joining eToro and opening a live trading account (SteadyProfits) in the middle of November 2018 was not the smartest move I could have made in hindsight.

In fact with the stock markets falling so sharply in such a short space of time, it was probably the worst possible time to open an account because it has been practically impossible to make any money from stock trading during this time.

Yes I could have opened some short positions, but I generally avoid opening short positions unless I am hedging an open position, and to be honest, I really didn’t think the stock markets would fall as much as they have done.

Trading Performance

It is normal to get some kind of Santa rally just before Christmas, but that failed to materialise this year with all the negative sentiment that surrounds the global economies at the moment.

However the markets have rallied after Christmas, and thankfully my portfolio is now looking a little healthier. Indeed, I have also received a few dividends this month, which has also helped boost my account a little bit.

Nevertheless, my account is still down quite a lot, and it was not the start I was looking for because these early stats are not going to attract any followers or copiers at all.

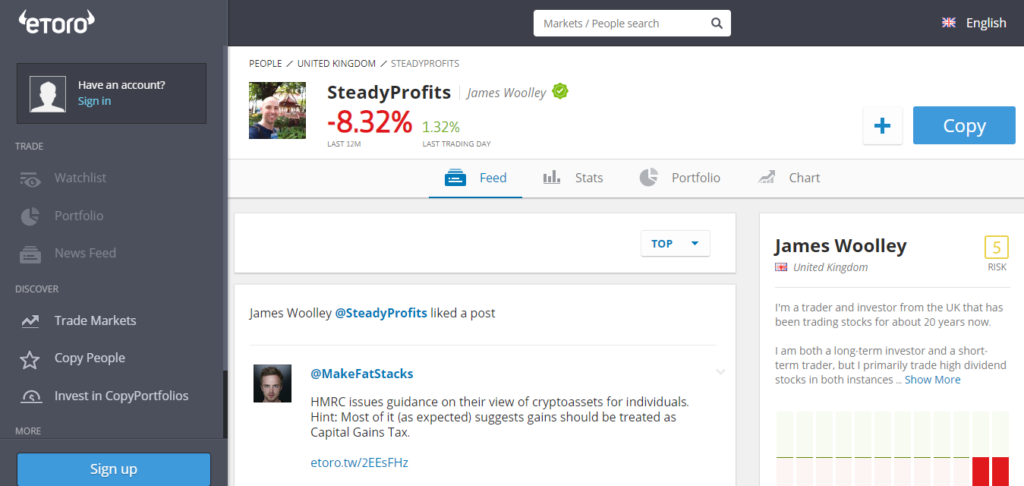

According to eToro, I am currently down 8.32% overall, as you can see below, but this isn’t strictly true.

I actually made the mistake of depositing a large amount of capital when my account was up a few weeks ago, and this had the effect of negatively distorting my stats.

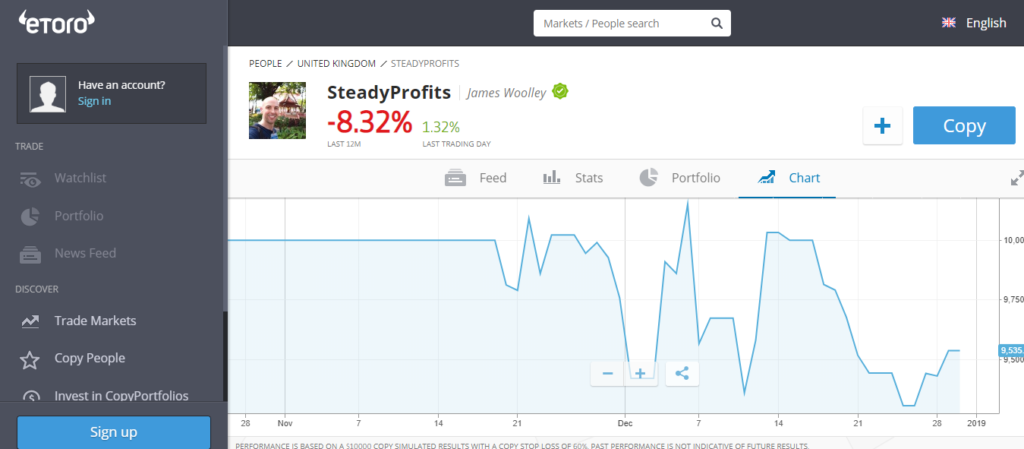

The chart of my performance shows the real story, and as you can see below, a theoretical starting account of $10,000 is now worth $9,535.93, which represents a running loss of just over 4.46%:

This is still not very good, but with the markets crashing so hard, I am not too dissatisfied with this performance as we head into 2019.

Current Portfolio

At the moment I hold a mixture of UK and US stocks. My core holdings are GVC (GVC.L) and Apple (AAPL), which I am very confident about.

Both are currently in negative territory, but in the long run, I have a target price of $200 for Apple and a minimum target price of 800p for GVC, although looking several years ahead, the price could easily reach £15 – £20 in my opinion if their partnership with MGM starts to generate some decent profits from the highly lucrative US market.

Apart of these two holdings, I have a decent investment in ISF.L, an ETF that tracks the FTSE 100, which should be a good long term investment at these levels, particularly as it pays a dividend of 1%+ every 3 months.

I also have two tobacco companies (BATS.L and PM), which have both fallen sharply in recent months, but they now have low P/E ratios and pay good dividends, so I am confident of making some good long term returns on both of these. However I am kicking myself for buying PM far too early. I definitely got my timing wrong on this one.

Finally, I am also invested in MDY, which tracks the mid-cap S&P companies. I also entered far too early here as well, but once again, this should be a decent long-term investment.

Risk Score

My risk score dropped to 4 just recently since I made a large deposit and started buying real stocks instead of taking leveraged positions. However it has since edged up to 5, possibly because I opened one leveraged position in the past week, which is still OK, but I will be looking to bring this back to 4 or less in the future.

Final Thoughts

Looking ahead, I am still confident that I will make some decent returns from my eToro trading account, and eventually start to attract some copiers in 2019.

My timing has been poor up until now, both in terms of when I opened an account and when I bought certain shares, but I will continue to invest in good quality high-dividend stocks, as well as undervalued ETFs and growth stocks, and will also continue to open a number of short-term trades when the right opportunities present themselves.

So I will finish by wishing you all a Happy New Year, and I hope that we can all make some decent profits in 2019 and beyond.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management. 81% of retail investor accounts lose money when trading CFDs with this provider.