A Profitable January

It is fair to say that my account is still suffering from the drubbing it took in November and December, which as I said before, was one of the worst times that I could have opened an account and started trading stocks.

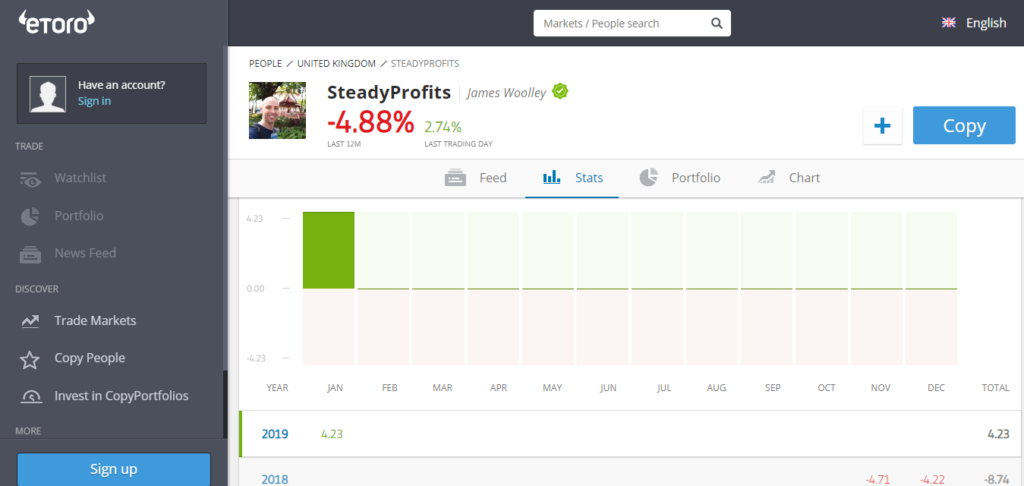

Nevertheless I’m not overly concerned because my eToro account (SteadyProfits) has recovered quite well in January, and I see this as a long-term game rather than a short-term road to riches.

At the time of writing, my account is up 4.23% this month with just one trading day left, but overall it is still down 4.88% since I first started trading in November.

(In reality my account is only down 0.82%, but I made the mistake of making a big deposit when I was in profit for the month, which has negatively distorted my performance results for the year).

Portfolio Analysis

After Apple (AAPL) and British American Tobacco (BATS.L) both surged higher this week, my overall portfolio is now looking a lot healthier.

Both of these stocks are now just below my entry price, but there is still a lot of upside potential in both instances because they are still massively undervalued based on their low P/E ratios.

I have a minimum long-term target price of $200 for Apple based on forward earnings estimates and I am still confident that BATS will hit 3000p at some point this year, which is about 15% higher than it is today.

I have one other tobacco holding – Philip Morris (PM) – and this too has recovered strongly, but I will probably look to get out at break-even in this case because my entry price was far too high in hindsight.

The good thing about PM is that it pays a decent dividend every 3 months, just like BATS, so I have no problem waiting for the price to recover, and I may just decide to hold on to it for a few years even if it gets back to $80.

My biggest holding is GVC, which is establishing itself as one of the biggest gaming companies in the world, but this has performed poorly this month.

Nevertheless this is very much a long-term holding and I am still holding out for a minimum price target of 800p, which should hopefully be taken out some time this year because it is still trading on a low P/E ratio and has a high dividend yield at its current price of 662p.

My only other holding is my FTSE 100 tracker (ISF.L), which is now up 1.52% overall, but I don’t really pay too much attention to the price of this ETF because this is a long-term holding that I intend to keep for many years because of its lucrative quarterly dividends and its long-term growth potential.

Short-Term Trades

As well as holding stocks for medium and long-term gains, plus of course the dividends, I also like to trade stocks on a short-term basis whenever I see some good opportunities, and in that respect, January has been a very profitable month.

I opened long positions on Aviva (AV.L), GVC (GVC.L) and IG Group (IGG.L), and managed to bank some decent profits from each of these stocks.

Outlook – Dividends Coming Soon

Although I am waiting for the markets to have some kind of pull-back in the coming weeks, I am very confident about the coming months because the ex-dividend date is rapidly approaching for all of the stocks and ETFs in my portfolio, and because eToro pays dividends on this ex-dividend date, these funds will soon be added to my account ready to be reinvested.

I also have a decent amount of cash sitting on the sidelines ready to be reinvested should the markets fall in the meantime, so I feel that I am in quite a strong position.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

You might also like to read my review of eToro to learn more about how this social trading platform works, if you haven’t already done so.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management. 81% of retail investor accounts lose money when trading CFDs with this provider.