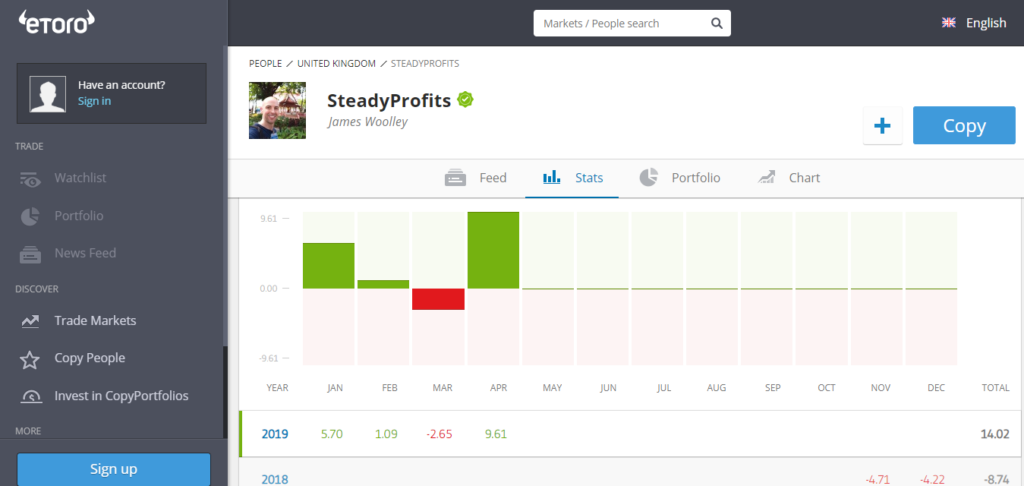

My Best Month Yet – Up 9.61%

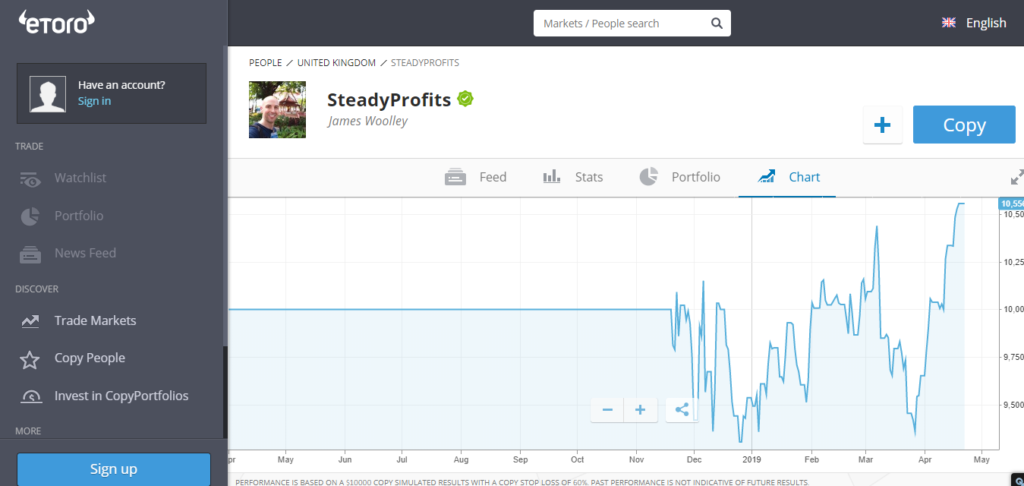

It’s Bank Holiday Monday here in the UK and the markets will remain closed for one more day, so I thought this would be a good time to discuss my latest trading performance on eToro for the month of April (trader profile = SteadyProfits).

If you read last month’s update, you will know that my portfolio took a big dip after the share price of GVC (my largest holding) fell sharply from 700p to just over 500p.

This panic selling was all caused by both the chairman and the CEO selling a large amount of shares, but after a positive trading update earlier this month, it would appear that nothing is fundamentally wrong with the company, and they are still on course to continue growing their profits, which has helped to reassure investors.

This has resulted in the share price bouncing back to around 648p, and I’m sure that it will continue creeping back up towards the 700p level in due course.

Furthermore, it has also meant that my portfolio is now in great shape once again. After falling 2.65% in March, the portfolio is currently up 9.61% so far this month (and is up 14.02% in 2019), which I am obviously delighted about.

Trading Summary / Dividends

As mentioned above, one of the main reasons why my portfolio is up so much is because GVC has bounced back so strongly, but other stocks have contributed to this gain as well.

I currently have three other stocks in my portfolio – International Airlines Group (IAG.L), Barclays (BARC.L) and Aviva (AV.L), and these are all in profit at the moment, helped by a positive overall stock market performance, because they are up 0.24%, 5.07% and 1.87% respectively.

In addition to this, I also sold my two holdings in HSBC (HSBA.L) for a profit of around 1% in the hope that I will be able to get back in lower, and banked a nice dividend of around 4% (after fees) from my Aviva (AV.L) shares.

Apart from this, there hasn’t been much trading activity because I can’t really find a lot of undervalued stocks right now, but I have some capital ready to invest should the markets fall in the near future.

Copiers

Despite being up over 14% up this year, and over 5% up overall, I still don’t have any people actively copying my trades on eToro, which is a little disappointing.

It seems to be quite hard to get noticed on eToro, and I understand that many people are reluctant to copy traders who don’t have a long trading history.

However it would still be nice to have just one or two people copying my trades because I want to help other people make some extra money as well.

Closing Comments

As you can imagine, I am still very happy with my overall trading performance, particularly after seeing the portfolio fall in value last month.

In the future I would like to reduce my exposure to GVC a little, despite being very bullish about their future prospects, and diversify a little more into other stocks if the opportunities present themselves.

However I am still very happy with my overall portfolio because I bought some undervalued high-dividend stocks at some decent prices, and am content to collect the dividends whilst waiting for their respective share prices to rise.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investor accounts lose money when trading CFDs with this provider.