Descending Triangle Breakout

Last week I was discussing the descending triangle that had formed on the price chart of Bitcoin, and highlighted how it was trading in an ever decreasing trading range prior to a possible breakout.

Here is the chart from this previous blog post:

Well as expected, the price couldn’t stay in this trading range forever, and it eventually closed below this long-established trading range earlier this week, as you can see below:

8000 Level Breached

The closing price of the breakout candle was $8693, which is where many people will have opened a short position, and it was no real surprise that the price continued to fall in the following days.

That’s because many traders will have been watching this descending triangle for many months, and will have been waiting to trade any breakout that subsequently occurred.

The price of Bitcoin actually fell below the $8000 level to around $7739 before bouncing back to its current price of around $8050.

So the breakout could have yielded nearly $1000 x the initial stake per point for anyone brave enough to trade this breakout, and even exiting at $8000, which would have been an obvious exit point for many traders, would have generated a profit of $693 x stake per point (minus the spreads).

Disclaimer – Bitcoin and other cryptocurrencies are highly speculative instruments, and it is possible to lose all of your capital.

Of course this breakout is still very much in its infancy, so there is still every chance that the price could drop even lower than its recent low of $7739, generating even more profits for those traders who decided to trade this breakout.

Sentiment

It is often interesting to look at market sentiment for any given market to see how bullish or how bearish traders are in general, and looking at the Bitcoin market on IG.com, 83% of clients with open positions are expecting the price to rise, and 17% are expecting the price to fall.

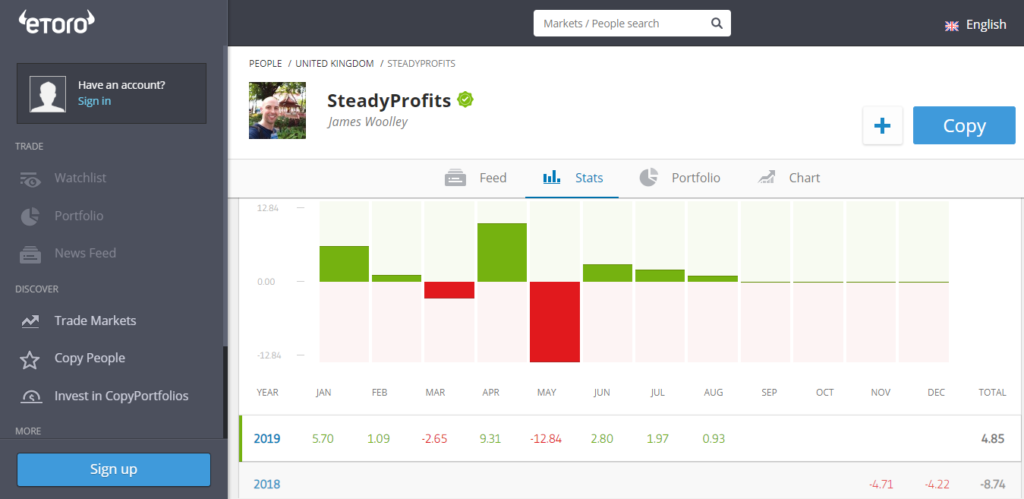

On eToro 98% of customers are buying Bitcoin at the time of writing, so these two stats would suggest that people are still very bullish on the long-term prospects of Bitcoin despite this downward breakout.

Final Thoughts

As I mentioned before, I don’t actually trade cryptocurrencies myself because of the risks attached and the relatively large spreads, but it is clear that these markets still conform very well to technical analysis because this was a textbook descending triangle breakout that has already yielded an excellent profit and may still fall even further.

With regards to future price predictions, I said in my last post that $8000 was within reach if there was a downward breakout and this has already been taken out. So I’m not really sure how much further it can fall in the near term.

It may well find a base at this new level and start to bounce back, or it could easily drop below $7000 if we have a few days where it closes below the psychological $8000 level. Either way, it should be interesting to watch.