An Excellent Month – Up 5.52%

There are still a few trading sessions left in 2019, but I wanted to write this update now so that I can enjoy the New Year celebrations.

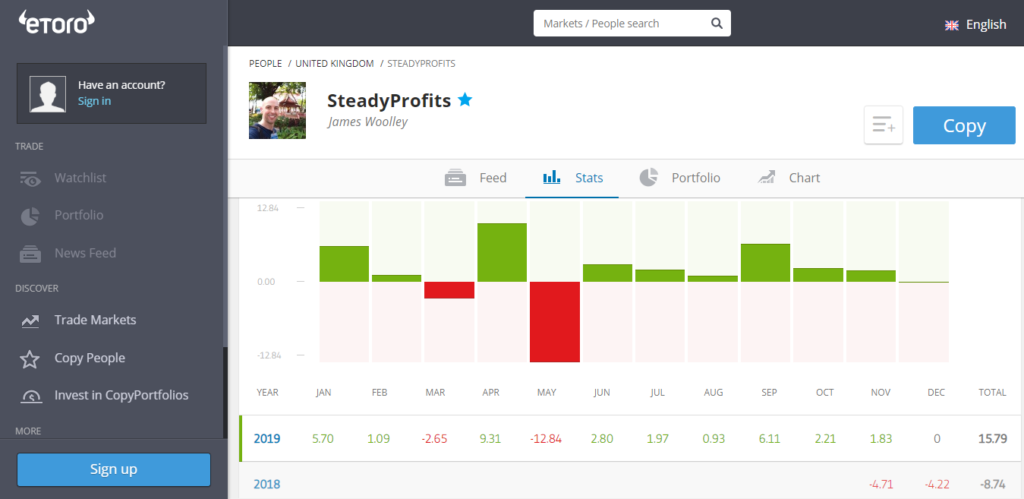

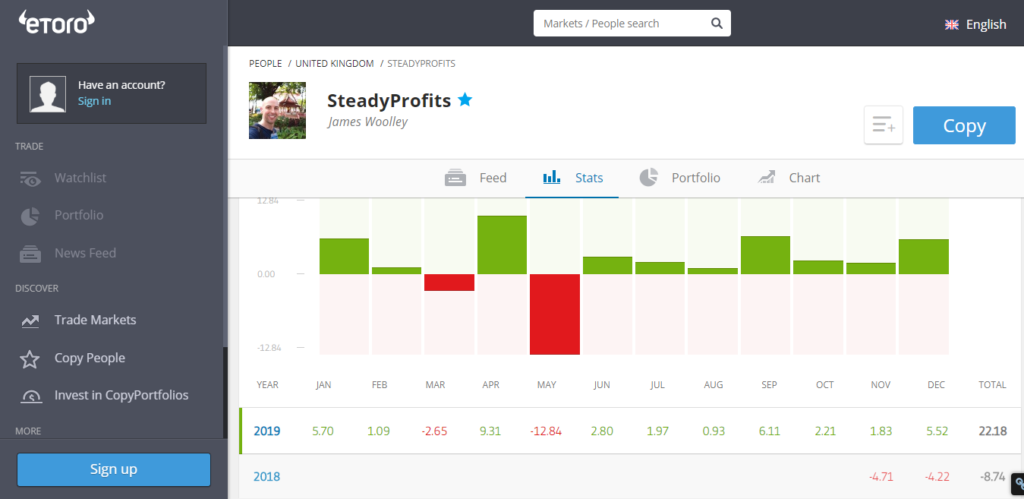

December is often an excellent month for the markets, and thankfully after we saw big losses in November and December of 2018, normal service was resumed this year and my eToro trading account has grown by 5.52% (following on from a 1.83% gain in November).

This has brought an end to my first full year as a trader on eToro, and as things stand, I am currently 22.18% up for the year, which is an excellent performance that I am absolutely delighted about.

I said last month that it was looking unlikely that I was going to finish the year 20% up, but the portfolio really pushed higher after this month’s General Election, and ended up smashing through this figure.

Trading Performance / Portfolio Update

One of the big success stories from this month was IAG (International Airlines Group).

I was still holding on to two lots of shares that I bought back in March at 564.11p and 576.52p, and after seeing the share price continually beaten down during the last three years of Brexit uncertainty, it finally surged higher to a more realistic level after the General Election result, and I was automatically closed out at 617.04p for an average gain of around 8.3%.

I also made the decision to sell my FTSE 100 tracker (ISF.L) after the FTSE 100 surged through the 7500 level. This was only a small position, and I was tempted to hold on to it for the long-term, but I felt this was a good chance to bank a nice profit and reinvest the proceeds into something else.

Finally, there was one other sale. With Imperial Brands continuing to stage a recovery, I took the opportunity to reduce my exposure slightly and sell off some of the shares that I bought at 1733.4 p for 1864.8p.

As a result of all this, I am now just over 22% in cash, and have a portfolio of just five stocks – Aviva, BP, Shell, HSBC and Imperial Brands. Three of these are currently in profit, but they all pay really high dividends, making them solid long-term holds.

Dividends Received

It was a quiet month with regards to dividends because there was only one holding that went ex-dividend, namely ISF.L.

The FTSE 100 tracker paid a dividend of less than 1% this quarter, but when you add on the capital gain as well, this was a good overall return when you consider that I only bought it at the start of the month.

Copiers

Last month I had four people copying my trades, and I am pleased to report that I am now ending December with a total of five copiers.

It was actually up to six earlier in the month but one person decided to stop copying my trades for whatever reason, even though he was already in profit.

Anyway I am still happy that I have five copiers, particularly as they are all now in profit at the time of writing this article, with my very first copier now up 5.24%.

Final Thoughts

Overall, I couldn’t be happier with my total gain of 22.18% for 2019. Of course it should be pointed out that it has been a very good year for the markets with the S&P 500 going up by a similar amount, but as a predominantly UK trader, I have definitely outperformed the FTSE 100 index, which is a more applicable benchmark.

I have also been very pleased with the eToro platform because although it does have its faults and limitations (it would be nice to be able to trade a lot more small and medium-cap stocks and have even more ETFs to trade), it’s generally been very reliable and it’s been fun interacting with the community there.

Looking ahead to 2020, I am confident in all my current holdings and believe that they will move higher in the coming year, and if there is a market correction, I have plenty of cash waiting on the sidelines ready to reinvest.

I never set myself any profit targets, but with the markets trading at very high levels, I think I would be happy with a total return of 10 – 20% next year.

I will finish by wishing you all a healthy and prosperous new year.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.