Bootcamp Challenge

Prop firm challenges have become very popular in recent years because for a small one-off fee, traders can gain access to a fully funded account if they successfully pass the challenge.

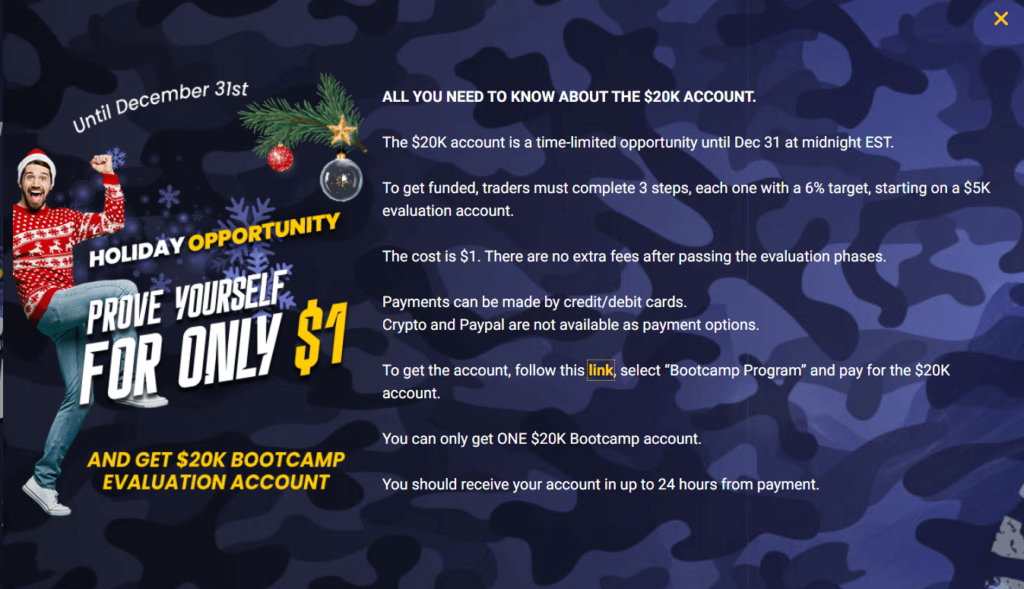

One of the most popular challenges is the Bootcamp challenge offered by The5ers, one of the most popular prop firms, and I have some exciting news to report because for a limited time only, you can now buy one of these challenges for just $1 until midnight on 31 December 2023 (usual price is $95).

Simply click on this link and click on Bootcamp challenge to take advantage of this offer.

Please note that this has proven to be a very popular promotion according to The5ers’ feed on X, so it may take a few hours to receive your account credentials, and the server has gone down a few times, so you may need to be patient during this time.

Passing the Challenge

The Bootcamp challenge is a real test of your trading skill because you are required to pass three individual challenges without breaching the 5% drawdown limit on each one.

The profit target is 6% for each phase of the challenge, which is quite hard to achieve, but it is not too demanding in comparison to the drawdown, and you do have an unlimited amount of time to pass each challenge.

Therefore you do not have to take excessive risks to complete the bootcamp challenge. You can simply trade slowly and steadily using your existing trading strategy, managing your risk accordingly to ensure that you don’t fail the challenge with a couple of bad trades.

If you do pass the challenge, there are no other fees to pay as part of this special $1 promotion, unlike the regular bootcamp challenge that requires a one-off fee to gain access to the fully funded account after passing the challenge.

The Rewards

If you are successful in your quest to pass each phase and complete the bootcamp challenge, you will start off with a $20K fully funded account and will then need to hit a profit target of 5% to scale up to the next level, $30K in this case, without breaching the drawdown limit of 4%.

You will receive 50% of the profits on the first level only, and then it goes up to 75% on each of the higher levels, before increasing to 80% at $2m and finally up to 100% when you reach the $2.5m level, where it will remain until the final level of $4m.

There are certain trading conditions that you should be aware of before you start trading. For example, a stop loss needs to be entered on every trade, and you cannot risk more than 2% per trade.

However you are allowed to trade the news, for example, and there are many instruments that you can trade, including currency pairs, indices, metals, commodities and cryptocurrencies.

So there is no reason why a skillful trader cannot pass this challenge and obtain a funded account.

How to Buy This $1 Challenge

If you have a debit or credit card, you can buy this bootcamp challenge online for just $1 (or your local currency equivalent).

You will then receive your evaluation trading account within 24 hours and will be able to start entering trades once you have downloaded and logged in to the MT5 trading platform using your login details.

→ Click here to buy this $1 bootcamp challenge

If you do take up this offer, I wish you the best of luck!