The prop industry has been exploding in popularity in recent years as more and more traders attempt to earn a fully funded account and trade with another company’s capital.

However yesterday it was rocked by the news that one of the biggest prop firms in this space, My Forex Funds, had been taken down and were being investigated by both Canadian and US regulators.

This will have been a devastating blow to the thousands of people from across the world who have one or more funded accounts with My Forex Funds, and the many others who have recently paid for challenges.

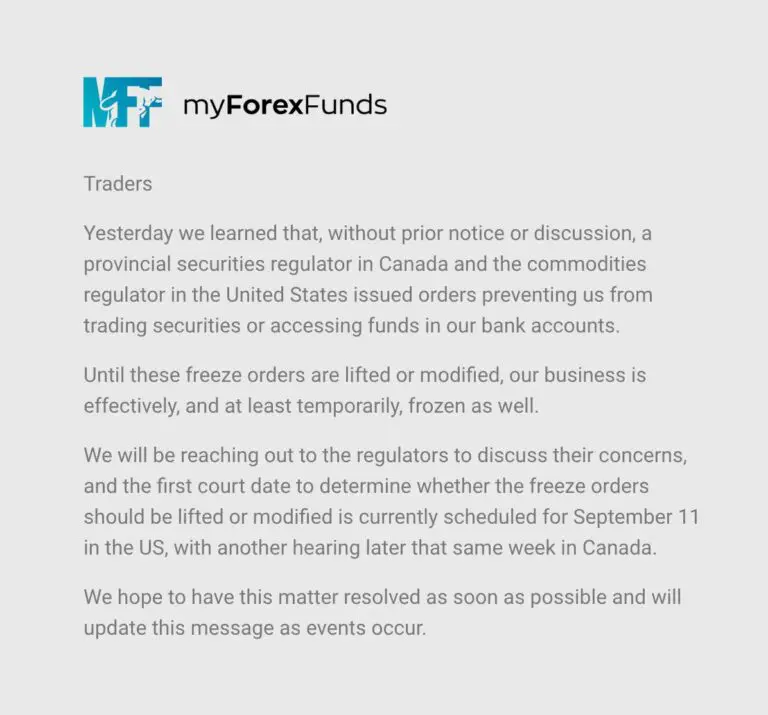

Website Notice

If you visit the MyForexFunds.com website, this is the notice that you will be presented with:

It has recently been updated because they originally stated that the company were being investigated by a Canadian regulatory body (where the company is based), but they have now disclosed that they are under investigation by a commodities authority (CFTC) in the US as well.

Why are My Forex Funds Being Investigated?

With more and more online prop firms opening up all the time, I think many people have been expecting the prop industry to be scrutinized a lot closer by regulators, and it now appears that this time has come.

Many of these prop firms are not regulated at all in the countries that they operate, and because they are enabling trading on a variety of instruments, both on simulated and live accounts in some cases, they are operating in a very grey area.

Furthermore, the whole business model of these prop firms has always been very dubious. In order to pay as much as 75-90% profit share of each fully funded trader’s profits, they require lots of traders to pay for (and fail) challenges, or go into drawdown and lose their account if they do pass the challenge.

Therefore this starts to resemble a ponzi scheme operation when you look at it closely.

Some companies claim that the fully funded traders do actually trade with real funds on a live account and that they mirror the trades of these traders to hedge themselves, but it is not clear if this is really happening or not.

In the case of My Forex Funds, some of the issues raised by the CFTC are pretty damning:

https://www.cftc.gov/PressRoom/PressReleases/8771-23

You will quickly discover that although My Forex Funds claimed that your success was their success, they were actively working against traders, whether that was through deliberate slippage when a trader was opening or closing a position, delayed fills or closing accounts abruptly.

Indeed if you watch this deep dive video from Rafael Kimmel, he goes through all of the key points raised in the CFTC documentation:

When Will This Investigation be Concluded?

According to My Forex Funds, the first court hearing is 11 September in the US, followed by a Canadian court hearing shortly afterwards.

So we should know more after this date, but it is possible that this investigation could take a lot longer, and anyone hoping for a quick resolution may well be disappointed.

Will Any Traders Receive Refunds?

It is far too early to know if anyone who has purchased a challenge or an instant funded account, or if anyone due a payout will receive any kind of refund when this investigation is finally settled.

It is a possibility, but even if you are entitled to a refund, it is often a long drawn out process and it could take months or even years to receive any money back.

Final Thoughts

It is worth emphasizing once again that this is an ongoing investigation and we should know a little more after 11 September.

I think the key takeaway from all this is that prop firms cannot be relied on to make a living.

You really need to have a personal trading account with an actual broker if you are generally profitable and want to earn a steady income because prop firms are unregulated, and any prop firm accounts that you currently have could easily disappear overnight.

Just today MyFundedFX have announced that they will no longer be accepting any new customers from Canada, so the knock-on effect of this investigation into My Forex Funds has already begun, and is likely to continue to impact this industry moving forward.