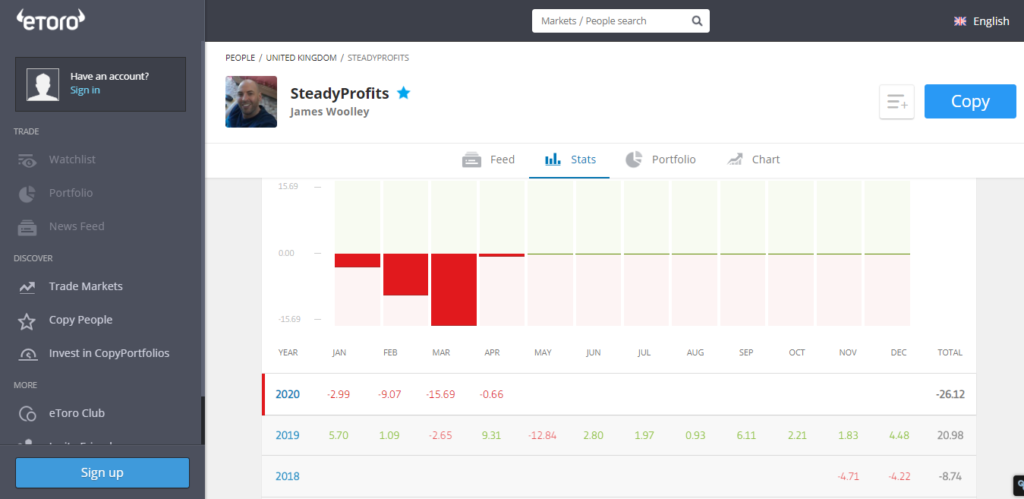

An Eventful But Flat Month – Down 0.66%

March was the month when the markets really plummeted around the world, with my own eToro portfolio falling in value by 15%, but April also turned out to be quite an eventful month.

The stock market falls continued and I was experiencing more losses at the start of the month, before the markets picked up again towards the end and at one point I was up just under 5% at the close of play on Wednesday.

However all of Wednesday’s gains were wiped out on the last day of the month, and I ultimately ended down 0.66% for the month.

Trading Performance / Portfolio Update

The fallout from the coronavirus has undoubtedly had a massive impact on my portfolio, however the fallout from the oil price collapse has been just as damaging.

In addition to all of my UK banks scrapping their dividends for the remainder of 2020, Royal Dutch Shell announced on Thursday that they are cutting their dividend payouts by around two thirds.

As a result of all this, I will now have significantly less dividend income coming in during the rest of the year. BP have said they will retain their dividend (for now), but apart from that healthy payment, it is only ISF, SPY, Visa and SHV that are providing any kind of income.

My three largest holdings are still BP, Royal Dutch Shell and HSBC, and I remain invested in Aviva, Barclays, Royal Bank of Scotland and Visa, and although they are all likely to remain low in the coming months, they should all recover over time.

I am also invested in ETFs that track the FTSE 100 and the S&P 500, and these will be held for years and years. I also have the short-term bond ETF SHV to provide a little income and protect my portfolio.

While I wait for my portfolio to recover, I am still actively trading in and out of stocks to generate some short-term gains for myself and my copiers.

This month I traded in and out of Barclays, BP, Google, Investec and Visa, and sold my Google shares for a small profit, but my best trade was American Express, which I bought at $82.34 and sold just one week later at $92.11 for a profit of 11.87%.

So it wasn’t a bad month overall with regards to my trading.

Dividends Received

As alluded to above, many dividends have been cut, but we did at least receive a dividend from SPY at the end of the month, although this is really small compared to many of our UK dividend stock payouts.

Copiers

Despite the poor performance of my trading portfolio, I still have 4 copiers as of the end of April, who I am very grateful for for sticking with me. I am working hard to ensure that all of them will see healthy profits in the future.

Risk Score

The volatility of the markets has meant that nearly all stocks have been assigned a higher risk score, which in turn has left me with a higher risk score of 7, despite the fact that I haven’t really made any major changes to my portfolio.

I think BP and Royal Dutch Shell are the two main culprits, particularly as they make up such a large part of my portfolio, but I am not going to sell either of them at these levels just to bring my risk score down.

Final Thoughts

After being up nearly 5% with one trading day left, I am obviously very disappointed to finish the month down 0.66%.

However moving forward I am fairly happy with the make-up of my portfolio, and remain confident that it will rise to previous highs once again once the worst of the coronavirus is behind us.

This is still some way off in my opinion, but I wouldn’t be surprised if the S&P 500 makes new highs as early as next year.

In the meantime I will continue to trade in and out of stocks to capitalize on the market volatility right now, and pick up any bargains for the long-term with any leftover cash.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply