November and December Results

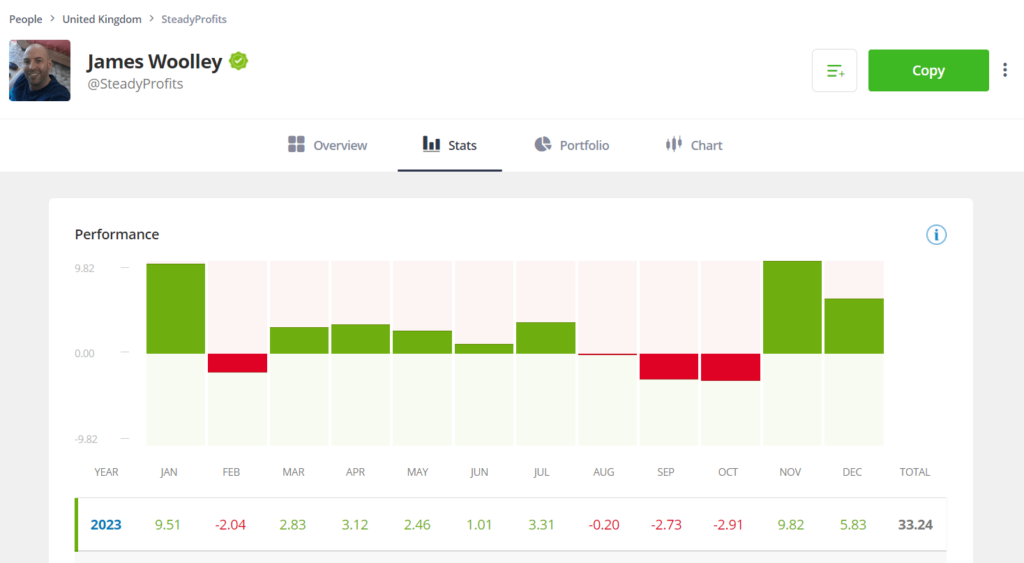

Before I discuss my overall performance for the year, I just want to update you with the results from November and December 2023 because these made a strong contribution to the final result.

- November +9.82%

- December +5.83%

As you can see, November was a big month for the portfolio with a gain of just under 10%, thanks largely to a big rebound in the US stock market that started at the end of October.

This continued into December with a traditional Santa rally that can be relied upon nearly every year to push share prices up, and this increased the value of the portfolio by a further 5.83%.

Overall Performance for 2023

Another strong month for me was January, right at the start of the year, which saw a gain of 9.51%.

Many of the other months saw more modest gains of 2 or 3%, but I was more than happy with that because the final result for 2023 was a gain of 33.24%.

Biggest Gainers

It is fair to say that Google (up 49% on my last purchase in February) and Amazon were two of the biggest gainers in 2023, along with the SPY ETF, which tracks the S&P 500.

However some of my UK dividend stocks have bounced back strongly and paid healthy dividends, especially IG and Aviva, and Catalyst Pharmaceuticals is currently over 41% in profit at $16.81, having originally bought at $11.90, and I think there is a lot more to come from this particular healthcare stock.

I have also traded in and out of this same stock a few times as well, which has helped to boost my performance stats.

Another strong gainer was Easyjet which gained just under 25% in two months before I decided to bank my profits on this stock last month.

Biggest Losers / Disappointments

Most of my portfolio stocks are now in profit, but I have one Russian stock that I am still unable to sell (Qiwi) and another stock that has been a constant disappointment (Tencent).

The fundamentals of Tencent remain strong, but it keeps experiencing setbacks every time the share price looks like recovering, and the recently announced regulation on Chinese gaming is the latest setback.

This is one stock that I am currently considering selling, and I may well replace it with Alibaba because I think this could be one of the strongest performing stocks in 2024 as it is hugely undervalued, with a very low P/E and a rapidly increasing free cash flow yield.

Recent Purchases

With regards to my most recent investments, I haven’t made too many changes to the portfolio. However after banking profits on Easyjet, I did buy back into two Chinese stocks, JD and Baidu, that were far too undervalued to ignore after they both saw some big sell-offs.

I think these will both do well in 2024, and as I just mentioned, I also really like Alibaba as well because this is arguably even better value right now, so this is probably next on my list when I next bank some profits.

Trading Strategy

With this current high interest rate environment, I have been very selective about the stocks that I have been buying.

For example, I will not even consider buying a stock that has high levels of debt because this is obviously very expensive to finance with interest rates so high compared to recent years.

Equally as important, I will only buy stocks that are generating large amounts of free cash flow that is forecast to grow even more in the next few years.

That’s because these companies are best equipped to deal with any recession if there is one, and have lots of capital to reinvest back into the business, buy back shares to increase the EPS or pay out to shareholders in the form of dividends.

IG Group is a good example of one such stock that satisfies both of these criteria, and this is currently up 12.1% and 22.25% (not including dividends) on the two purchases that I made in 2023.

Finally, as in any economic climate, I always want to see some degree of revenue and earnings growth moving forward to help maintain a steadily rising share price over time, and I use analyst forecasts, trading updates, conference calls, webinars, etc. to help me with this.

I should point out that I do place a few forex trades in this eToro account from time to time, but I mainly use this account to trade a global portfolio of stocks.

Risk Score

My risk score has remained between 3 and 4 in 2023, which indicates that I have a fairly low-risk strategy, so a gain of over 33% is a decent result when you compare it to the overall risk of the trading strategy and the portfolio of stocks held.

Copiers

At the end of 2023, I do not currently have any active copiers as I am not currently part of the Popular Investor program, and therefore do not receive a great deal of exposure.

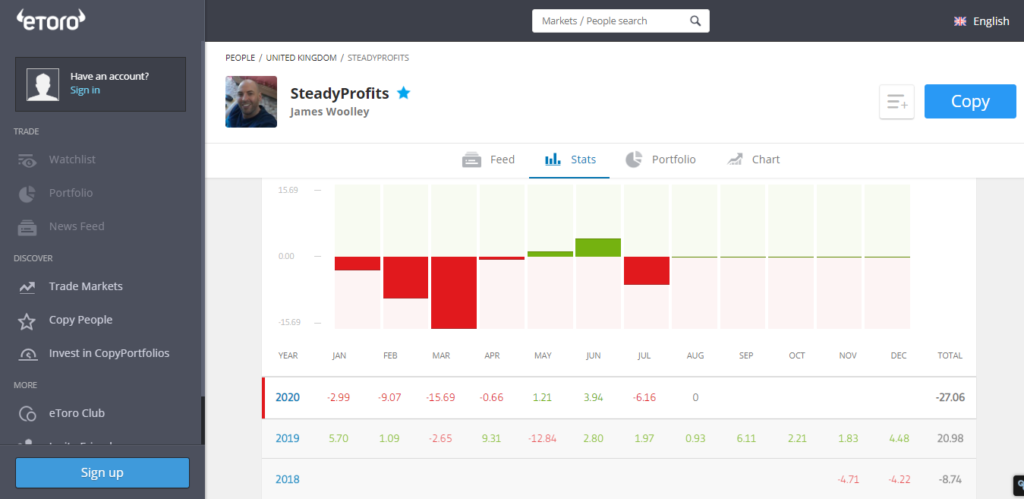

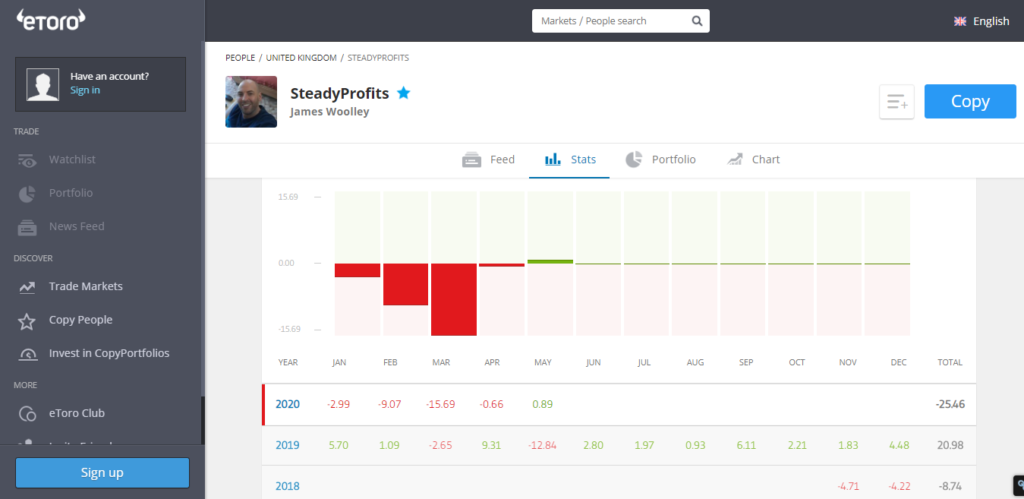

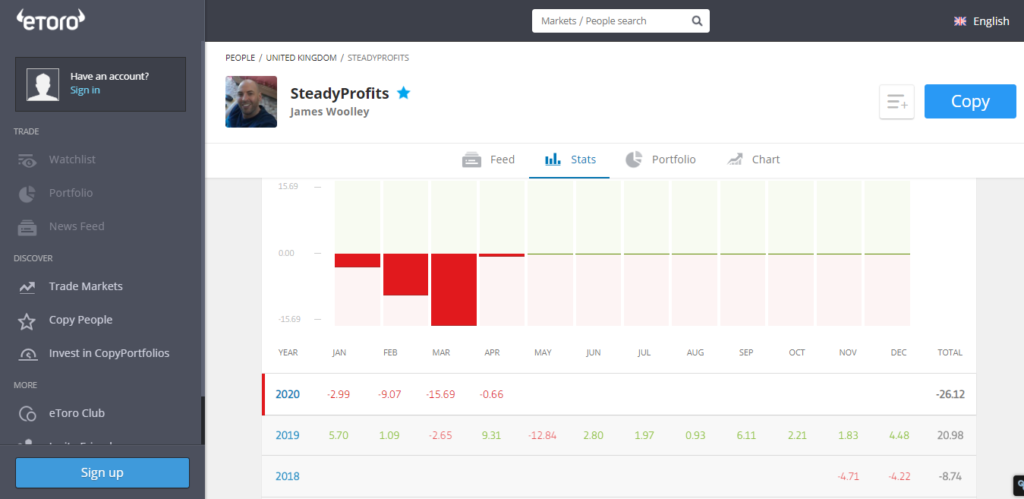

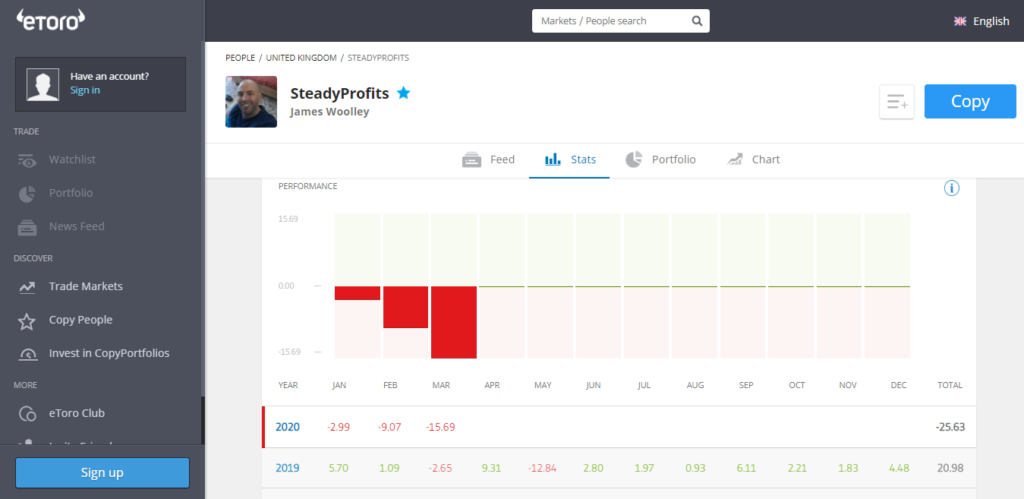

However I also understand that many prospective copiers will be wary of the losses made in previous years, and I can completely relate to that.

So all I can do is to stick to my current strategy of investing in quality growth stocks that are generating large amounts of free cash flow, and hopefully the performance of this year can be repeated in 2024 and beyond.

Final Thoughts

While I am delighted with my overall performance in 2023, I can not take too much satisfaction because of the disappointment of previous years.

In previous years I was trying out different strategies and undoubtedly bought too many speculative early-stage companies that ultimately resulted in some big losses because I was too stubborn to cut my losers early.

However I have now gone back to the strategy that I use for my retirement accounts which is to only invest in proven quality companies that have little or no debt and are increasing their earnings and their free cash flow every year, and preferably paying a dividend as well.

Follow Me on eToro

If you would like to automatically copy my trades in eToro, my username on this platform is SteadyProfits and you can copy my trades here if you have an account with eToro.

You can also track my performance and see my latest trades from the same page.

Whether you choose to follow me or not, I wish you luck with your trading and investing, and hope that you have a great 2024!