Modest Gains – Up 0.93%

The British summer is not usually a good time for stocks, and in fact they will often head lower on lower volumes at this time of the year.

So I am relatively happy to have seen the value of my eToro portfolio rise by 0.93% this month, following on from slightly larger gains in both June and July.

Sadly the large falls actually occurred in May for me, but the portfolio is now looking much healthier, boosted by some nice dividends and improved share price performance for many of my holdings.

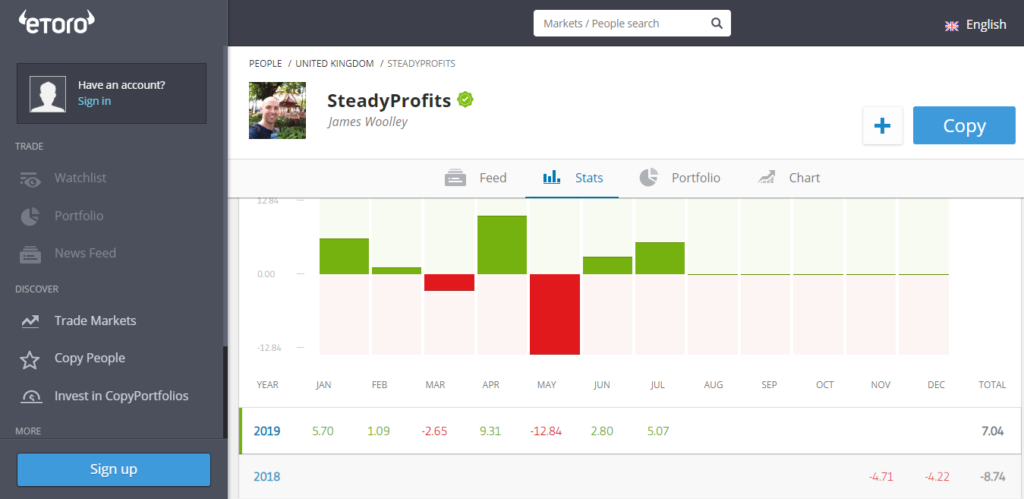

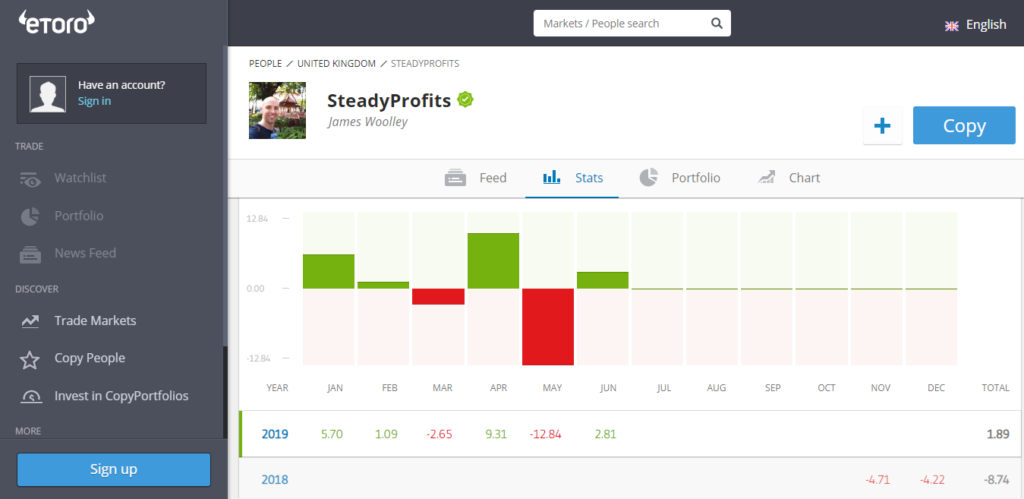

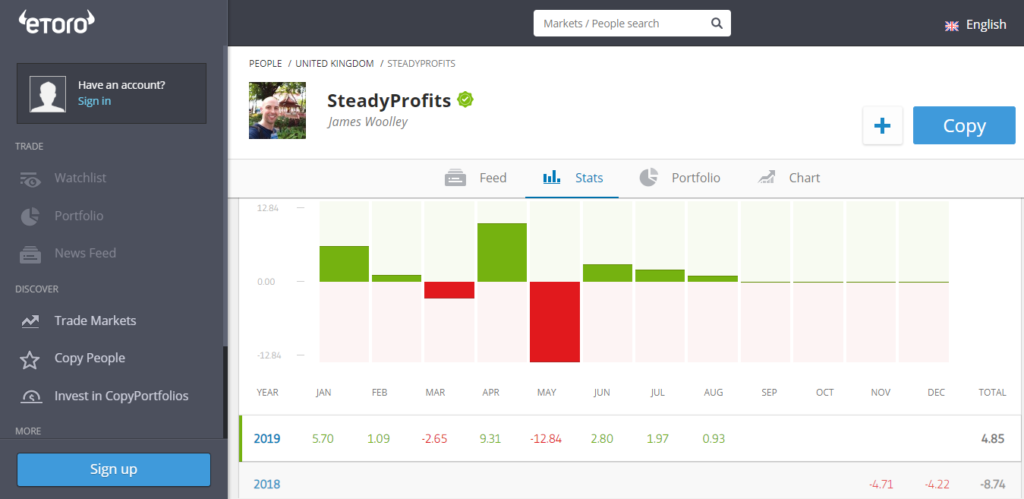

As you can see from the image below, my eToro trading account (account name = SteadyProfits) is now up 4.85% in 2019:

Dividends Received

August was a very good month in terms of dividends because three of my four main share holdings went ex-dividend this month, and because eToro pay dividends into your account on the ex-dividend date, I have already received all of these dividends.

The companies that went ex-dividend were Aviva (AV.L), GVC (GVC.L) and Imperial Brands (IMB.L).

Trading Performance / Current Portfolio

In terms of trading activity, it has again been quite a quiet month, mainly because I was fully invested most of the time, making it impossible to trade shorter term positions.

Nevertheless, at the very start of the month I did sell some of my Aviva shares that I had bought a few days previously for a profit of just over 2%, and after receiving dividends from GVC, I decided to sell a small portion of shares that I bought at 583.8p for 613.2p, for a profit of around 5%.

As a result of this, I am now going into September with around 12% in cash and around 88% invested in stocks. Ideally I would like to invest this cash into other stocks or sell some of my shares for a profit when the opportunity arises and then diversify more because I am too heavily invested in a small number of stocks right now.

At the moment I hold Aviva, GVC, Imperial Brands and International Airlines Group, and would be happy to buy more of any of these because they are all hugely undervalued at the moment.

However it is better to be more diversified and there are plenty of other stocks that are looking very cheap, such as Legal & General, Taylor Wimpey and Royal Dutch Shell, for example. So I shall be watching all of these other stocks very closely for an opportunity to buy.

Copiers

At the time of writing I still have no active copiers and I haven’t had any new followers in the last month, but I am not at all surprised by this.

I am not happy with the overall performance of my trading / investing account, even though it is up 4.85% this year, so I don’t expect others to be impressed by this either.

I am hopeful that the stocks that I am invested in will continue to recover throughout 2019, particularly once the Brexit mess is sorted out, and would like to see the portfolio up more than 10% before the end of the year, at which point people might be more inclined to copy and follow my account.

Final Thoughts

Anyone who is looking at my share portfolio may be alarmed to see some large falls of between 11.32% and 22.63%, but I am honestly not worried at all.

I have been an active share trader and investor for many years and have a long record of success with my significantly larger ISA account.

Furthermore, all of my stocks are undervalued and predicted to continue growing their profits in the coming years, and they all pay decent dividends in the meantime, so I am fully prepared to sit and wait for them all to recover no matter how long it takes.

If I have an opportunity to make some short-term trades with any leftover cash, I will try to do just that in order to boost the portfolio and give me some more money to reinvest.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.